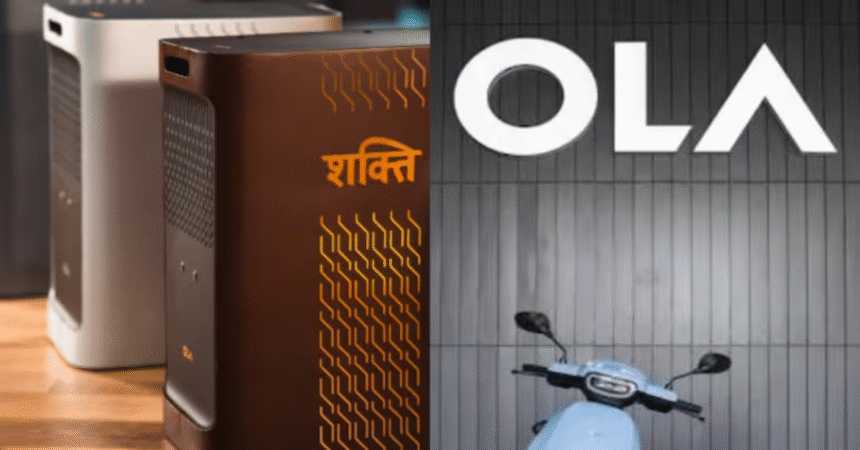

Ola Shakti — Ola Electric’s Foray into India’s BESS Market

With Ola Shakti, Ola Electric moves beyond mobility to claim its stake in India’s booming Battery Energy Storage Systems (BESS) market. This launch is not just a new product — it’s a bold strategic shift. In this article, we explore what Ola Shakti is, how it works, what this means for Ola and India’s energy sector, and what challenges lie ahead.

Table of Contents

- What Is Ola Shakti?

- Why BESS? India’s Market Opportunity

- Key Features, Configurations & Pricing

- Technology Backbone: 4680 Bharat Cell, Gigafactory & Infrastructure

- Business Strategy & Competitive Advantage

- Market & Investor Reaction

- Risks, Challenges & Dependencies

- What’s Next for Ola Shakti

- Conclusion

- FAQs

1. What Is Ola Shakti?

Ola Shakti is Ola Electric’s first residential Battery Energy Storage System (BESS). Designed to help homes and small businesses store energy intelligently, it enables switching between grid power and stored battery backup seamlessly.

Ola positions it as India’s first fully indigenous residential BESS — designed, engineered, and manufactured domestically — leveraging its battery cell technology and manufacturing muscle. The Economic Times+3Business Standard+3Entrepreneur+3

According to the regulatory filing, Ola stated:

“We have built world-class battery and cell technology for electric mobility. Ola Shakti extends that innovation to homes, helping them store and use clean energy intelligently.” Business Standard

The company sees this as a natural expansion, relying on its existing 4680 cell platform, the Gigafactory, and its nationwide sales network to scale the product without large incremental capital expenditure. Hindustan Times+3Business Standard+3Entrepreneur+3

2. Why BESS? India’s Market Opportunity

India is on the cusp of a major shift in energy architecture — from only generation and distribution to storage. A few key drivers:

- Rapid renewable addition: As solar and wind generation increase, managing intermittency requires robust storage.

- Grid stability & peak demand: Battery systems help bridge gaps during peak load or grid stress.

- Declining battery costs: Advances in battery technology have made BESS more affordable and efficient.

- Government support: Policies and incentives are favoring clean energy and storage solutions.

- Residential demand: Unreliable power, load shedding, and premium consumers wanting energy independence create demand for at-home storage.

Ola projects India’s BESS market to be ₹1 trillion today, with growth to ₹3 trillion by 2030. Business Standard+2The Bridge Chronicle+2

Ola expects to consume 5 GWh annually in its Gigafactory operations for its BESS business in the coming years. Business Standard+2Entrepreneur+2

3. Key Features, Configurations & Pricing

Configurations & Pricing

Ola Shakti is being launched in four capacity variants:

| Variant | Capacity / Power (approx) | Intro Price* |

|---|---|---|

| Entry | 1.5 kWh | ₹29,999 Hindustan Times+3Business Standard+3Entrepreneur+3 |

| Mid | 3 kWh | ₹55,999 Business Standard+2Entrepreneur+2 |

| Advanced | 5.2 kWh | ₹1,19,999 Business Standard+2Entrepreneur+2 |

| Premium | 9.1 kWh | ₹1,59,999 Business Standard+2Entrepreneur+2 |

* Prices applicable for the first 10,000 units. Reservations began at ₹999. Deliveries are anticipated from Makar Sankranti 2026. Hindustan Times+3Business Standard+3The Bridge Chronicle+3

Performance & Technical Features

- Instant switching / Zero downtime: The system claims instantaneous changeover (0 ms), so connected appliances are not interrupted. Business Standard+1

- Efficiency & durability: Up to 98% efficiency, and no regular maintenance. Business Standard

- Voltage range & protection: Operates over a wide voltage window (120V–290V). Business Standard+1

- Weather-proof & rugged design: Batteries are IP67 rated (protection against dust & water) for outdoor or semi-outdoor installation. Business Standard

- Smart features & app control: Real-time monitoring, usage analytics, backup prioritisation, remote diagnostics, OTA (over-the-air) updates. Business Standard+2Entrepreneur+2

- Modes & scalability: Likely modes including time-of-day (ToD) charging, backup mode, auto switch, etc. Scalability options hinted at for future expansion. Entrepreneur+2Ola Electric+2

Usage Claims

Ola claims Shakti can power ACs, refrigerators, induction cookers, pumps, and more on full load for about 1.5 hours (for higher variants) when the grid fails. Hindustan Times+2ETAuto.com+2

Charging time: Some variants might charge fully in around 2 hours under favorable conditions. Hindustan Times

On its official page, Ola markets Shakti as “India’s home-grown battery for uninterrupted independence — store energy, power your entire home, and stay uninterrupted on or off the grid.” Ola Electric

4. Technology Backbone: 4680 Bharat Cell, Gigafactory & Infrastructure

A critical reason Ola claims to scale Shakti efficiently is its existing battery and manufacturing infrastructure.

- 4680 Bharat Cell: Ola has developed its own 4680-format battery cell (“Bharat Cell”), which is used in EVs. This same cell platform is extended to Ola Shakti. Ola Electric+2Entrepreneur+2

- Gigafactory: Ola’s large-scale battery & cell production facility (in Tamil Nadu) is positioned as the manufacturing hub for Shakti. The company claims it can leverage this facility without adding major new capex. Entrepreneur+2Hindustan Times+2

- Sales & Distribution Reach: Ola plans to use its existing EV sales & service network — Ola dealerships and stores — to reach customers. This gives it a ready distribution backbone. Entrepreneur+2Business Standard+2

- Zero incremental R&D / Capex claims: Ola claims the expansion into BESS via Shakti can happen with minimal incremental R&D or capital investment because of shared cell tech and infrastructure. Entrepreneur+2Business Standard+2

However, recent media reports suggest that while the Shakti product has been launched, the cell manufacturing ambitions have faced delays or regulatory caution. Hindustan Times

5. Business Strategy & Competitive Advantage

Why Ola Shakti May Succeed

- Leverage mobility reputation & brand: Being “Ola Electric” gives credibility and existing captive customers.

- Economies of scale: Shared cell technology across EVs and BESS may reduce per-unit costs.

- Distribution & customer reach: EV network can act as sales + service kiosks for Shakti.

- First-mover in residential BESS in India: Owing to indigenous design and integrated manufacturing, Ola claims a lead. Entrepreneur+2Business Standard+2

- Growth synergy: As EV adoption grows, BESS becomes complementary — households may already align with clean energy.

Challenges & Competition

- Established companies in battery storage (e.g., Tesla, LG, others) and niche BESS players.

- Utility-scale BESS vs residential: competition is different.

- Reliability and lifecycle: home systems must last many years under varied conditions.

- Upfront cost barrier: even ₹29,999 for 1.5 kWh is non-trivial for many.

- Regulatory & grid integration issues: net metering, interconnection standards, subsidies.

6. Market & Investor Reaction

The launch of Shakti had an immediate positive impact on the market:

- Ola Electric shares rose ~5% after the announcement. The Economic Times+3The Economic Times+3ETAuto.com+3

- Over the past few sessions, the share price has rallied ~15%, partly driven by optimism about BESS’s business expansion. The Economic Times+2HDFC Sky+2

This reaction indicates investor confidence in diversification and future revenue streams beyond two-wheelers.

7. Risks, Challenges & Dependencies

Even with a promising start, Ola Shakti faces important risks:

- Manufacturing delays: Cell plant or gigafactory delays can bottleneck supply.

- Regulation & policy shifts: BESS incentives, electricity tariffs, and home energy policies matter.

- Competition pressure: Global and local players might undercut or offer advanced battery tech.

- After-sales & service: Ensuring a support network for battery maintenance and warranty claims is critical.

- Technology obsolescence: Battery tech evolves fast — newer chemistries might make older ones less competitive.

- Adoption rate: Consumer acceptance of residential BESS is still nascent in India.

- Financial viability: Ola’s claim of zero incremental capex and immediate profitability is optimistic; true margins will depend on scale and operational costs.

Moreover, while launching Shakti, Ola is also under pressure for its earlier commitments. For example, the government had issued a notice over Ola missing the battery plant setup target under the PLI scheme. Reuters

8. What’s Next for Ola Shakti

- Deliveries & rollout: Shakti deliveries are expected to start from Makar Sankranti 2026. The Economic Times+3Hindustan Times+3Business Standard+3

- Scaling GWh usage: Ola hopes that BESS cell consumption exceeds that for EV batteries in the coming years. Entrepreneur+1

- Grid-scale / container BESS products: Ola has hinted at “Container” (modular) grid BESS for logistics, dark stores, etc. Entrepreneur

- Expansion to smart-grid integration: Potential tie-ups with energy providers, rooftop solar ecosystems.

- Software platform & AI optimizations: Improvement in smart energy managementforecasting and grid participation.

- Global expansion: If successful at home, Ola could export BESS solutions.

Conclusion

With Ola Shakti, Ola Electric has taken a bold step beyond mobility into the heart of India’s energy transition. The product ambitions are strong: indigenous design, shared cell technologies, scalable manufacturing, and integrated distribution. While market reaction has been favorable and the opportunity huge, execution will determine success. If Ola can deliver reliability, cost-efficiency, and robust support, Shakti could become a landmark in India’s shift to clean, resilient energy.

TVS Apache RTX 300 Launched: Powerful Adventure Tourer with Stunning Features & Game-Changing Specs